If you’re not sure, choose Not sure/Other/None for now, and then consult your accountant.Ĭlick Save when you’re done with this section. Select the tax form your company files for tax purposes. Enter the employer ID (EIN)Ĭlick Save when you’re done with this section. Don’t worry if you get this wrong you can change it later.Ĭlick Save when you’re done with this section.

Choose Accrual to report income when you bill a customer choose Cash to report income when you receive payment from a customer. Most small businesses choose Cash.

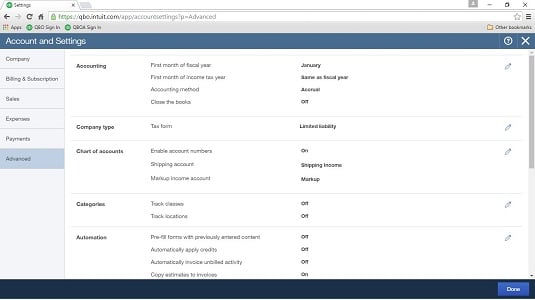

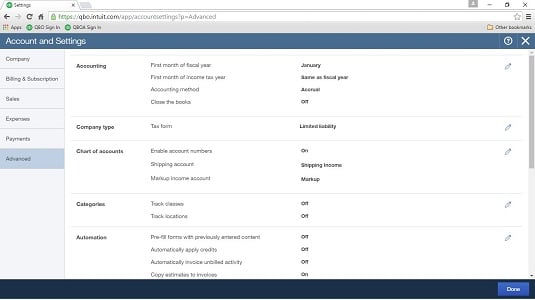

Click on the Question Marks if you’re not sure what a field is used for.Ĭlick Save when you’re done with this section. To enter the address and e-mail that you want your customers to see on invoices: Add the “customer” address and “customer email” fields. The logo shows up on invoices, sales receipts, and purchase orders.Ĭlick “ Add legal name” if the company has a different name for legal purposes.Įnter your company’s address as well as other contact information. Click on Company settings on the left (if it’s not already clicked).Ĭlick on the pencil icon on the right to edit any of the fields.Ĭlick Customize logo to upload a logo. In this post, I will cover the Company settings. The Company Settings windows shows settings for: You can customize the look, feel, and inner workings of QuickBooks Online by editing the company Settings.Ĭlick on the Gear Icon on the upper right. We’ll take it one section at a time so that you don’t get overwhelmed. In the next series of blog posts, I will show you how to customize QuickBooks Online – company settings and other important settings.

How do you get QuickBooks Online tailored specifically for your company? Customizing QuickBooks Online will help you to streamline your workflows so that you can work efficiently and save time.

0 kommentar(er)

0 kommentar(er)